Financial Planning for Climate Change: Safeguarding Your Wealth

Financial planning for climate change involves assessing and mitigating the financial risks posed by climate change, protecting your assets through strategic investments, insurance, and adaptation measures to ensure long-term financial security.

Climate change is no longer a distant threat; it’s impacting our lives and, crucially, our finances. Understanding and integrating financial planning for climate change is essential to protect your assets and secure your financial future in an increasingly uncertain world.

Climate Change: A Direct Threat to Your Finances

Climate change presents significant challenges to our planet, and its effects extend far beyond environmental concerns. The economic and financial implications are becoming increasingly apparent, directly impacting personal finances and investment strategies. It’s crucial to understand how these changes can affect your assets and what steps you can take to mitigate the risks.

Understanding the Economic Impacts of Climate Change

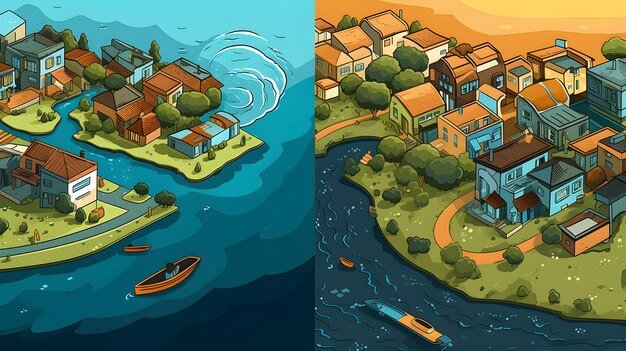

Climate change is causing widespread economic disruption. Extreme weather events, such as hurricanes, floods, and wildfires, are becoming more frequent and intense, leading to significant property damage and infrastructure failure. Agricultural yields are also affected, leading to food price increases and supply chain disruptions.

The Financial Risks You Need to Know

Several key financial risks are associated with climate change: physical risks from damage to property, transition risks from policy and technology changes, and liability risks from legal actions against companies contributing to climate change. Each of these risks can impact your investments, insurance costs, and overall financial stability.

- Increased insurance premiums: As climate-related disasters become more common, insurance companies are raising premiums to cover increasing claims.

- Devaluation of assets: Properties in high-risk areas, such as coastal regions, may lose value as the threat of flooding and erosion increases.

- Investment losses: Companies heavily reliant on fossil fuels or those failing to adapt to a low-carbon economy may face financial struggles.

Climate change is not just an environmental problem—it is a financial one. Understanding these direct and indirect impacts is the first step in making informed decisions to protect your financial well-being.

Assessing Your Personal Climate Risk

Before you can develop a robust financial plan for climate change, it’s essential to assess your personal climate risk. This involves evaluating your exposure to the physical, transitional, and liability risks associated with climate change and identifying the vulnerabilities in your financial portfolio.

Evaluating Physical Risks

Start by evaluating the physical risks to your property and assets. Are you living in an area prone to flooding, wildfires, or hurricanes? Consider the potential damage to your home, vehicles, and other valuable possessions from extreme weather events.

Understanding Transition Risks

Transition risks arise from the shift towards a low-carbon economy. This includes policy changes, technological advancements, and market shifts. Assess how these factors may affect your investments, employment prospects, and the value of your assets. For example, industries reliant on fossil fuels may face reduced demand and financial challenges.

Identifying Liability Risks

Liability risks involve legal actions against companies and individuals contributing to climate change. While this might not directly affect most individuals, it’s important to consider how companies you invest in are managing their environmental impact and potential legal liabilities.

- Review insurance policies: Understand what your homeowners and auto insurance policies cover in the event of climate-related disasters.

- Assess home vulnerabilities: Take steps to protect your home from extreme weather, such as installing flood barriers or reinforcing your roof.

- Diversify investments: Spread your investments across different sectors to reduce the impact of transition risks.

Assessing your personal climate risk is an ongoing process that requires staying informed about the latest climate science, policy changes, and market trends. By understanding your vulnerabilities, you can take proactive steps to protect your financial well-being.

Strategic Investments for a Climate-Resilient Portfolio

Investing in companies and sectors that are aligned with a sustainable, low-carbon future can help protect your portfolio from climate-related risks while also potentially generating long-term returns. Consider these investment strategies to build a climate-resilient portfolio.

Investing in Renewable Energy

Renewable energy is a rapidly growing sector driven by the global transition away from fossil fuels. Investing in solar, wind, and other renewable energy companies can provide exposure to a high-growth industry while supporting sustainable development.

Supporting Green Infrastructure

Green infrastructure projects, such as sustainable buildings, water management systems, and public transportation, are essential for adapting to climate change. Investing in companies involved in these projects can offer both financial and environmental benefits.

Embracing Sustainable Agriculture

Sustainable agriculture practices, such as regenerative farming and organic food production, can reduce greenhouse gas emissions and improve soil health. Investing in companies that promote these practices can support a more resilient and sustainable food system.

- Diversify across sustainable sectors: Don’t put all your eggs in one basket. Spread your investments across different sustainable sectors to reduce risk.

- Consider ESG funds: Environmental, Social, and Governance (ESG) funds invest in companies with strong sustainability practices.

- Engage with companies: Use your shareholder rights to encourage companies to adopt more sustainable practices and disclose their climate-related risks.

Building a climate-resilient portfolio isn’t just about financial returns; it’s about aligning your investments with your values and contributing to a more sustainable future. By investing strategically, you can protect your wealth while supporting positive environmental and social outcomes.

Insurance Strategies for Climate-Related Disasters

Insurance is a critical tool for managing the financial risks associated with climate-related disasters. However, traditional insurance policies may not adequately cover the full extent of the damages caused by extreme weather events. It’s essential to review your insurance coverage and consider additional protections to safeguard your assets.

Understanding Your Homeowners Insurance Policy

Your homeowners insurance policy should cover damages to your home from various hazards, including fire, wind, and hail. However, most standard policies don’t cover flood damage, which requires a separate flood insurance policy. Review your policy carefully to understand what is covered and what is excluded.

Considering Flood Insurance

If you live in a flood-prone area, flood insurance is essential. The National Flood Insurance Program (NFIP) offers flood insurance policies to homeowners, renters, and business owners in participating communities. Private flood insurance options are also available.

Adding Riders and Endorsements

You may need to add riders or endorsements to your insurance policy to cover specific climate-related risks. For example, you may want to add coverage for damage from earthquakes, landslides, or wildfires.

- Assess your coverage needs: Consider the potential cost of repairing or replacing your home and belongings in the event of a climate-related disaster.

- Shop around for the best rates: Compare quotes from different insurance companies to find the best coverage at the most affordable price.

- Keep your policy up to date: Review your insurance policy annually to ensure it still meets your needs and reflects any changes in your risk profile.

With the right insurance coverage, you can protect your assets and minimize the financial impact of climate-related disasters. Don’t wait until it’s too late—take steps today to review and enhance your insurance protection.

Adaptation Measures to Protect Your Property

In addition to insurance, adaptation measures can help protect your property from the physical impacts of climate change. These measures can range from simple home improvements to large-scale infrastructure projects.

Home Improvements for Climate Resilience

Several home improvements can enhance your property’s resilience to climate change. This includes reinforcing your roof, installing impact-resistant windows, and elevating your home above flood level.

Landscaping for Climate Protection

Strategic landscaping can also help protect your property. Planting trees can provide shade and reduce the urban heat island effect. Installing rain gardens and permeable pavements can help manage stormwater runoff and reduce the risk of flooding.

Community-Level Adaptation

In addition to individual efforts, community-level adaptation measures are essential for protecting entire neighborhoods and cities. This includes building seawalls, restoring wetlands, and improving drainage systems.

- Conduct a home energy audit: Identify areas where you can improve energy efficiency and reduce your carbon footprint.

- Install a rainwater harvesting system: Collect rainwater for irrigation and other non-potable uses.

- Advocate for community-level adaptation: Support local initiatives to build climate resilience in your community.

By taking proactive adaptation measures, you can reduce your vulnerability to climate change and protect your property from the worst impacts of extreme weather events.

Long-Term Financial Planning in the Face of Climate Change

Climate change requires a long-term perspective on financial planning. It’s essential to integrate climate considerations into your overall financial strategy, including retirement planning, estate planning, and philanthropic giving.

Adjusting Retirement Plans

Climate change can impact retirement plans in several ways. Rising healthcare costs due to climate-related illnesses, increased living expenses in climate-resilient areas, and investment losses from climate-related disruptions can all affect your retirement savings. Consider adjusting your retirement plans to account for these factors.

Considering Climate-Smart Estate Planning

Estate planning should also consider climate change. Properties in high-risk areas may lose value over time, affecting the distribution of assets to your heirs. Consider diversifying your estate to reduce the impact of climate-related risks.

Philanthropic Giving for Climate Solutions

Philanthropic giving can be a powerful way to support climate solutions and build a more sustainable future. Consider donating to organizations working on climate mitigation, adaptation, and resilience.

- Seek professional advice: Consult with a financial advisor who understands climate-related risks and opportunities.

- Regularly review your financial plan: Climate change is a dynamic issue, and your financial plan should be updated regularly to reflect the latest developments.

- Educate yourself and others: Stay informed about climate change and share your knowledge with family, friends, and colleagues.

Long-term financial planning in the face of climate change requires a holistic approach that integrates climate considerations into all aspects of your financial life. By taking proactive steps, you can protect your wealth, support climate solutions, and leave a positive legacy for future generations.

| Key Point | Brief Description |

|---|---|

| 🔥 Assess Risk | Evaluate your personal and financial exposure to climate-related hazards. |

| 🛡️ Review Insurance | Ensure your insurance covers climate-related disasters like floods and wildfires. |

| 🌱 Invest Sustainably | Consider investments in renewable energy and sustainable infrastructure. |

| 🏡 Adapt Property | Implement measures to protect your property from climate-related damage. |

Frequently Asked Questions

▼

▼

▼

▼

▼

Conclusion

Financial planning for climate change is no longer optional—it’s essential. By assessing your risks, diversifying investments, enhancing insurance coverage, and taking proactive adaptation measures, you can protect your assets and secure your financial future in an increasingly uncertain world. Start planning today to ensure a more resilient and sustainable tomorrow.