Credit Card Interest Rate Caps: Understanding the Debate & Consequences

Credit card interest rate caps spark a national debate, weighing consumer protection against potential economic impacts on lenders and credit availability, with consequences affecting both individual borrowers and the broader financial system.

Navigating the world of credit cards can be tricky, especially when it comes to understanding interest rates. The discussion around credit card interest rate caps: a national debate and its consequences has become increasingly important as consumers seek ways to manage their debt more effectively.

Understanding Credit Card Interest Rate Caps

Credit card interest rate caps are legal limits on the amount of interest that credit card companies can charge consumers. These caps are often proposed as a way to protect consumers from predatory lending practices and excessive debt accumulation. However, the implementation of such caps is a complex issue with potential benefits and drawbacks for both consumers and lenders.

The Purpose of Interest Rate Caps

Interest rate caps aim to make credit more affordable for consumers, particularly those with lower incomes or poor credit scores who may be more vulnerable to high-interest rates. By setting a limit on interest charges, caps can prevent credit card companies from exploiting consumers through exorbitant fees and rates.

Historical Context of Interest Rate Caps

The concept of capping interest rates is not new. Usury laws, which regulate the amount of interest that can be charged on loans, have existed for centuries. In the United States, many states have their own usury laws, although the applicability of these laws to credit cards has been a subject of debate and legal interpretation.

Here are some key benefits and drawbacks of interest rate caps:

- Benefits: Protects vulnerable consumers, reduces debt accumulation, promotes financial stability.

- Drawbacks: May limit credit access for some consumers, could reduce credit card availability, might increase fees.

- Economic impact: Affects lender profitability, influences credit market dynamics, shapes consumer behavior.

Understanding these interest rate caps requires a careful balancing act between protecting consumers and ensuring a healthy, functioning credit market.

The National Debate: Arguments For and Against Caps

The idea of establishing national credit card interest rate caps has spurred a vigorous debate, with strong arguments coming from both sides. Proponents argue that caps are essential for consumer protection, while opponents claim they could harm the credit market.

Arguments in Favor of Interest Rate Caps

Advocates for interest rate caps often highlight the potential for these caps to shield consumers from predatory lending practices. They argue that without caps, credit card companies can charge excessively high interest rates, trapping vulnerable individuals in cycles of debt.

Arguments Against Interest Rate Caps

Opponents of interest rate caps argue that these caps could restrict credit access, particularly for individuals with lower credit scores. They suggest that credit card companies might reduce their lending to higher-risk borrowers if they cannot charge interest rates that compensate for the risk.

Consider these viewpoints:

- Consumer Advocates: Believe caps protect consumers and promote fairness.

- Financial Institutions: Argue caps could reduce credit availability and increase costs.

- Economic Analysts: Offer varied perspectives on the potential economic impacts.

The debate over national credit card interest rate caps is complex and multifaceted, involving economic, social, and ethical considerations.

Potential Consequences of Interest Rate Caps

The implementation of credit card interest rate caps could have extensive and varied consequences, affecting both consumers and the financial industry. It’s important to explore these potential outcomes to understand the full impact of such regulations.

Impact on Consumers

For consumers, interest rate caps could mean lower borrowing costs and reduced debt accumulation. However, it might also lead to decreased credit availability, particularly for those with lower credit scores.

Impact on the Credit Card Industry

The credit card industry could face reduced profitability and changes in lending practices. Companies might tighten their lending standards, reduce rewards programs, or increase fees to offset the impact of interest rate caps.

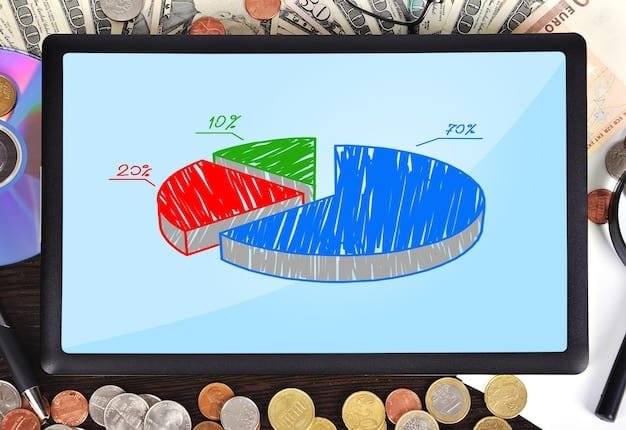

The consequences could include:

- Reduced Credit Access: Higher-risk borrowers may find it harder to obtain credit cards.

- Altered Lending Practices: Companies may change how they assess and manage risk.

- Increased Fees: Some fees might rise to compensate for lower interest revenue.

Understanding the potential consequences is very important for informed policy-making and consumer awareness.

State vs. Federal Interest Rate Caps

The regulation of interest rates can occur at both the state and federal levels, each with its own distinct approaches and implications. Understanding the differences between state and federal regulations is crucial for grasping the full scope of the interest rate cap debate.

State Usury Laws

Many states have usury laws that limit the amount of interest that can be charged on various types of loans, including credit cards. However, the application of these laws to credit cards can be complex, especially since credit card companies often operate across state lines.

Federal Regulations

Federal regulations, such as the Truth in Lending Act (TILA), provide certain protections for consumers regarding credit card interest rates and fees. However, there is no federal law that directly caps credit card interest rates across the board.

Here’s a comparison of state versus federal approaches:

- State Laws: Vary widely, may have limited applicability to national credit card issuers.

- Federal Regulations: Provide baseline protections, but don’t directly cap interest rates.

- Preemption Issues: Federal law can sometimes preempt state laws, creating regulatory challenges.

The interplay between state and federal regulations can create a complex landscape for both consumers and credit card companies.

Alternatives to Interest Rate Caps

While interest rate caps are one approach to addressing high credit card costs, several alternative strategies can also help consumers manage their debt and promote financial stability. These alternatives may offer a more balanced and sustainable solution.

Financial Literacy Programs

Improving financial literacy can empower consumers to make informed decisions about credit and debt management. These programs can teach consumers about budgeting, saving, and the responsible use of credit.

Debt Counseling Services

Debt counseling services can provide consumers with personalized advice and support for managing their debt. Counselors can help consumers create debt repayment plans, negotiate with creditors, and explore options for debt consolidation or relief.

Alternative strategies include:

- Financial Education: Empowers consumers to manage their finances effectively.

- Debt Counseling: Provides personalized support and guidance.

- Low-Interest Credit Options: Encourages the availability of more affordable credit products.

Often, various approaches may be more effective than relying solely on interest rate caps.

The Future of Credit Card Regulation

The future of credit card regulation in the United States is uncertain, but several trends and developments could shape the landscape in the coming years. These include evolving consumer needs, technological advancements, and ongoing debates about the role of government in regulating the financial industry.

Potential Legislative Changes

Legislators may consider proposals to establish national interest rate caps, strengthen consumer protections, or promote greater transparency in credit card pricing and fees. The outcome of these legislative efforts will depend on various factors, including political dynamics and economic conditions.

Technological Innovations

Technological innovations, such as fintech lending platforms and digital payment systems, could also influence the future of credit card regulation. These innovations may create new opportunities for consumers but also pose new challenges for regulators.

Looking ahead, consider these possibilities:

- Legislative Action: Potential for new laws and regulations.

- Technological Impact: Influence of fintech and digital payment systems.

- Consumer Empowerment: Continued efforts to promote financial literacy and consumer protection.

Keeping an eye on future changes can ensure that consumers and industry stakeholders stay informed and adaptable.

| Key Point | Brief Description |

|---|---|

| 🛡️ Consumer Protection | Caps can protect consumers from predatory interest rates. |

| 📉 Credit Access | Caps may reduce credit availability for some borrowers. |

| 🏛️ State vs. Federal | Regulations exist at both levels with different approaches. |

| 💡 Alternatives | Financial literacy and debt counseling are viable options. |

Frequently Asked Questions

▼

▼

▼

▼

▼

Conclusion

The debate surrounding credit card interest rate caps highlights the complexities of balancing consumer protection with the economic realities of the credit market. While caps may offer some benefits, especially for vulnerable consumers, they also carry potential risks, such as reduced credit availability and altered lending practices. Alternative strategies, such as financial literacy programs and debt counseling services, may offer more sustainable solutions for promoting financial stability and responsible credit use. The ideal path forward involves careful consideration of these various factors and a commitment to evidence-based policy-making.