Debt Management for Gig Workers: Navigating Income Volatility in the US

Debt Management for Gig Workers: Navigating Income Volatility delves into the unique financial challenges faced by gig workers in the US, offering strategies for managing debt amidst fluctuating incomes and unstable employment conditions.

The rise of the gig economy has brought flexibility and autonomy to millions, but it also presents unique financial challenges, particularly when it comes to debt management for gig workers: navigating income volatility. The unpredictable nature of gig work can make budgeting, saving, and repaying debts a daunting task.

Understanding the Financial Landscape of Gig Work

Gig work offers freedom but often lacks the stability of traditional employment. Understanding the financial landscape is the first step in effective debt management.

The Inconsistent Income Challenge

One of the biggest hurdles for gig workers is inconsistent income. Earnings can fluctuate wildly from month to month, making it difficult to plan and budget effectively.

Limited Access to Traditional Benefits

Unlike traditional employees, gig workers typically don’t receive benefits like health insurance, paid time off, or retirement contributions, which can create additional financial strain.

- Track your income and expenses diligently to identify trends and patterns.

- Create multiple income streams to diversify your earnings and reduce risk.

- Build an emergency fund to cover unexpected expenses or periods of low income.

Successfully navigating the financial landscape of gig work requires careful planning, disciplined budgeting, and a proactive approach to managing debt.

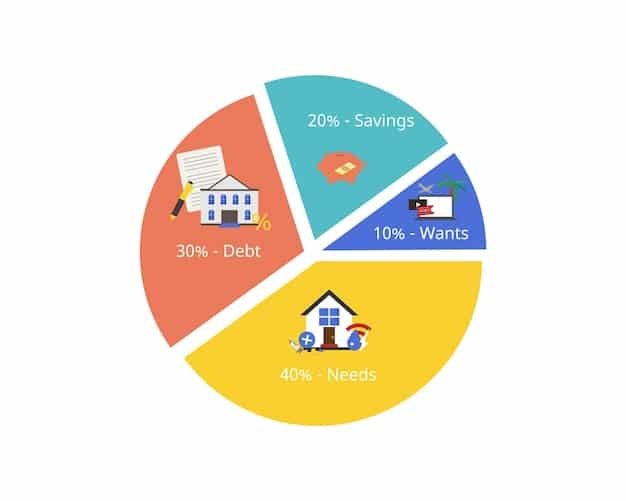

Creating a Realistic Budget for Variable Income

Budgeting with a variable income requires adaptation and flexibility. Traditional budgeting methods may not work as effectively for gig workers.

Prioritize Essential Expenses

Start by identifying and prioritizing essential expenses such as housing, food, transportation, and healthcare. These should be the foundation of your budget.

Use Averaging and Forecasting

Calculate your average monthly income over the past few months and use this as a basis for forecasting future earnings. Be conservative in your estimates to avoid overspending.

- Implement a zero-based budget where every dollar is allocated to a specific purpose.

- Use budgeting apps and tools to automate tracking and analysis of your income and expenses.

- Review and adjust your budget regularly to account for changes in your income or expenses.

By creating a realistic and adaptable budget, gig workers can gain control of their finances and minimize the risk of accumulating debt.

Strategies for Managing Debt Effectively

Effective debt management is crucial for gig workers to maintain financial stability during periods of fluctuating income.

Prioritize High-Interest Debt

Focus on paying down high-interest debts such as credit cards first, as they can quickly become overwhelming. Consider balance transfers or debt consolidation to lower interest rates.

Negotiate with Creditors

Don’t hesitate to negotiate with creditors for lower interest rates or more manageable payment plans. Many creditors are willing to work with borrowers who are experiencing financial difficulties.

Debt Snowball vs. Debt Avalanche Methods

Two popular debt repayment strategies are the debt snowball method (paying off the smallest debts first) and the debt avalanche method (paying off the highest-interest debts first). Choose the method that best suits your financial personality and goals.

- Avoid taking on new debt unless absolutely necessary.

- Explore options for debt counseling or credit repair if you’re struggling to manage your debt on your own.

- Consider automating your debt payments to ensure you never miss a due date.

Implementing smart debt management strategies can help gig workers stay on top of their finances and avoid the pitfalls of overwhelming debt.

Building an Emergency Fund for Financial Security

An emergency fund is a crucial safety net for gig workers, providing a buffer against unexpected expenses and income fluctuations.

Set a Savings Goal

Determine how much you need in your emergency fund to cover several months’ worth of essential expenses. Aim for at least three to six months’ worth.

Automate Your Savings

Set up automatic transfers from your checking account to your savings account each month. Even small amounts can add up over time.

Cut Unnecessary Expenses

Identify areas where you can cut back on spending and redirect those savings to your emergency fund. Small lifestyle changes can make a big difference.

Building an emergency fund provides peace of mind and financial security, allowing gig workers to weather unexpected challenges without resorting to debt.

Tax Planning for Gig Workers

Tax planning is a critical aspect of financial management for gig workers. Understanding your tax obligations and taking proactive steps can help you avoid surprises at tax time.

Track Your Income and Expenses

Keep detailed records of all income and expenses related to your gig work. This will help you accurately calculate your taxable income and identify potential deductions.

Understand Estimated Taxes

As a gig worker, you’re typically required to pay estimated taxes on a quarterly basis. Work with a tax professional to determine the correct amount to pay and avoid penalties.

Take Advantage of Deductions

Many expenses related to your gig work are deductible, including home office expenses, business travel, and supplies. Familiarize yourself with the available deductions and keep accurate records to support your claims.

- Consult with a tax professional for personalized advice and guidance.

- Use accounting software or apps to track your income and expenses and generate tax reports.

- Stay informed about changes to tax laws and regulations that may affect your gig work.

Effective tax planning can help gig workers minimize their tax burden and avoid costly mistakes. It can also enable debt management by giving you insight into how much you have coming in and going out.

Long-Term Financial Planning and Retirement Savings

While day-to-day financial management is essential, gig workers should also focus on long-term financial planning and retirement savings.

Open a Retirement Account

Consider opening a SEP IRA or Solo 401(k) to save for retirement. These accounts offer tax advantages and can help you build a substantial nest egg over time.

Diversify Your Investments

Don’t put all your eggs in one basket. Diversify your investments across different asset classes to reduce risk and maximize potential returns.

Set Realistic Goals

Determine how much you’ll need to save each month to reach your retirement goals. Start small and gradually increase your contributions as your income grows.

- Work with a financial advisor to develop a personalized investment strategy.

- Take advantage of employer-sponsored retirement plans if you have access to them.

- Review and adjust your retirement plan regularly to account for changes in your financial situation.

By prioritizing long-term financial planning, gig workers can secure their financial future and enjoy a comfortable retirement.

| Key Point | Brief Description |

|---|---|

| 💰 Budgeting | Create a realistic budget considering income volatility. |

| 🚨 Emergency Fund | Build a fund to cover 3-6 months of essential expenses. |

| 🧾 Tax Planning | Track income and expenses for accurate tax filing. |

| 🏦 Debt Management | Prioritize high-interest debt; negotiate with creditors. |

Frequently Asked Questions

▼

▼

▼

▼

▼

Conclusion

Managing debt as a gig worker requires a proactive and strategic approach. By understanding the unique financial challenges, creating a realistic budget, managing debt effectively, building an emergency fund, and planning for taxes and retirement, gig workers can achieve financial security and thrive in the gig economy.